2021: Q1 Sales & New Listings

/in Asking Prices, Average Sales Price, Inventory Levels, Jackson Hole Real Estate, Jackson Hole Report, Land/Building Sites, Listing Prices, Luxury Property, Market Report, Market Reports, Market Statistics, Monthly Market Update, Multi-family, Over $1 million, Past Sales, Properties under $500, Real Estate Sales, Sale to List Price Ratio, Sales Volume, Sellers, Single family homes, The Jackson Hole Report, Town of Jackson, Townhome, Under $500, WY/by Molly StewartTransactions/Sales Volume – What Sold?

$2,970,116

Average Sales Price

$389M

Total Sales Volume

Market Analysis

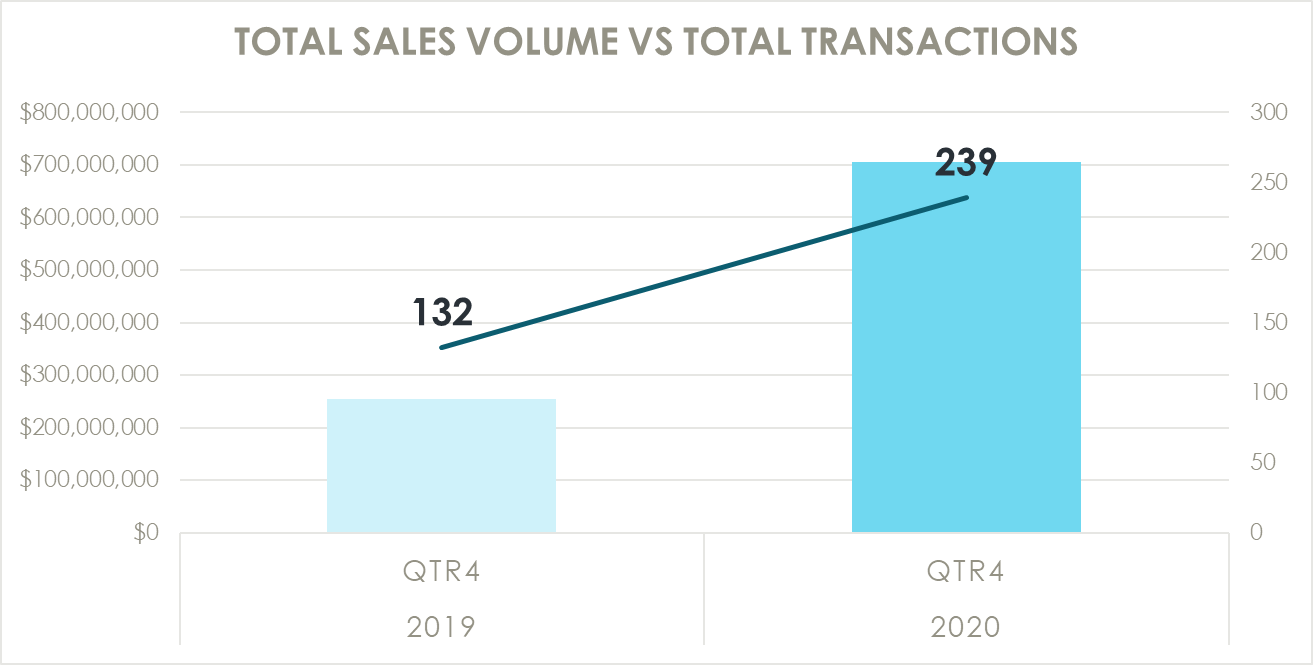

Reviewing first quarter stats is very helpful in evaluating the pre-pandemic real estate market to the post-pandemic real estate boom seen here in Jackson Hole as well as many other places in the country. We all know the market increased, but by how much? There were 40 more real estate sales in Q1 2021 than the same time in 2020, an increase of 44%. Despite seeing fewer sales in January 2021, sales in February and March were roughly double the pre-pandemic levels seen in early 2020. Sales volume has skyrocketed, with $175 million MORE in volume in Q1 2021, a staggering increase of 82% over the start of 2020. Similar to transactions, sales volume was inline with January 2020, but in February and March sales volume was double that of 2020, for a grand total of $389 million in the first quarter of 2021. It’s interesting to note that the 4-year average for sales volume in the first quarter is only $172 million – we’ve seen quite the increase over the last 5 years!

The average sale price was up each month and up $600,000 over the quarter, representing a 26% increase from early 2020. The median sale price was also up every month, ranging from $1.65 million to $2.14 million. Sales increased in nearly every price point with the largest increase in the $3 million and up segment, where there were 18 more sales in the first quarter of 2021. Sales in the $1-3 million range also saw a significant increase with 17 more sales this year. The biggest shift in property type was for vacant lots where nearly 2 times as many building sites sold in the first quarter of 2021, representing 24% of all sales (up from 16% in Q1 2020).

New Listings – What’s New?

$3,483,409

AvERAGE LIST PRICE

$433,241,500

LIST PRICE Volume

Market Analysis

New listings in the first quarter of 2021 are actually up when compared to the start last year. The number of new listings this year outpaced 2020 in both January and March for a total of 10 more listings in the first quarter, an increase of 8.7%. This doesn’t necessarily mean there are more things to buy as nearly all of the available inventory was cleared out in Q3 & Q4 2020 during the pandemic inflicted real estate boom here in Jackson Hole. With only 10 more listings, the total listing volume was up $127 million, a staggering increase of 41.5%. After outpacing listing volume in January, and seeing similar levels in February, listing volume was $100 million higher in March 2021, with only 5 more listings. As to be expected, the average listing price jumped from $2.733 million before the pandemic, to $3.483 million in the start of 2021, an increase of $750,000 or 27%. This significant increase was no doubt helped by the month of March 2021 where the average listing price nearly reached $4 million. The average median listing price also increased significantly, going from $1.67 million to just over $2.2 million, an increase of over $500,000, equating to a 32% jump.

More building sites entered the market in Q1 2021, representing 23% of all new listings (vs. 17% in Q1 2020). Nearly all of the available lot inventory was sold out in Q3 and Q4 2020, no doubt encouraging other lot owners to take advantage of low supply levels and put their (snow covered) property on the market in early 2021. Currently there are only 19 lots for sale in all of Teton County! The first quarter saw a spike in new listings over $3 million with 20 more properties hitting the market in this price point. On the other end of the spectrum, there were 11 fewer listings under the $1 million mark. Currently there are only 8 properties in all of Teton County available under $1,000,000.